Emotions are important. We should listen to them… most of the time at least. However, investing is one case when it’s best to let rational thought take priority over your emotions. By all means, listen to your emotions, but don’t be led by them.

Here’s a slightly shocking fact: In 2018, the S&P 500 generated an average return of 9.85% annually. However, research by Dalbar found that the average investor earned roughly half of that: 5.19%.

Why? Humans are emotional creatures and investing is an emotional experience, therefore investors are tempted to make rash decisions like rapidly selling during a market downturn.

When investing, a patient, logical approach is usually the most effective over the years. This means prioritising long-term investments over the impulse to buy and sell based on your emotions or short-term goals.

We’ll admit that it’s hard to avoid becoming entangled in media hype or fear, something that can lead you to buying at the peak and selling at the bottom of the market, so you need to be self-aware enough to recognise when this is happening.

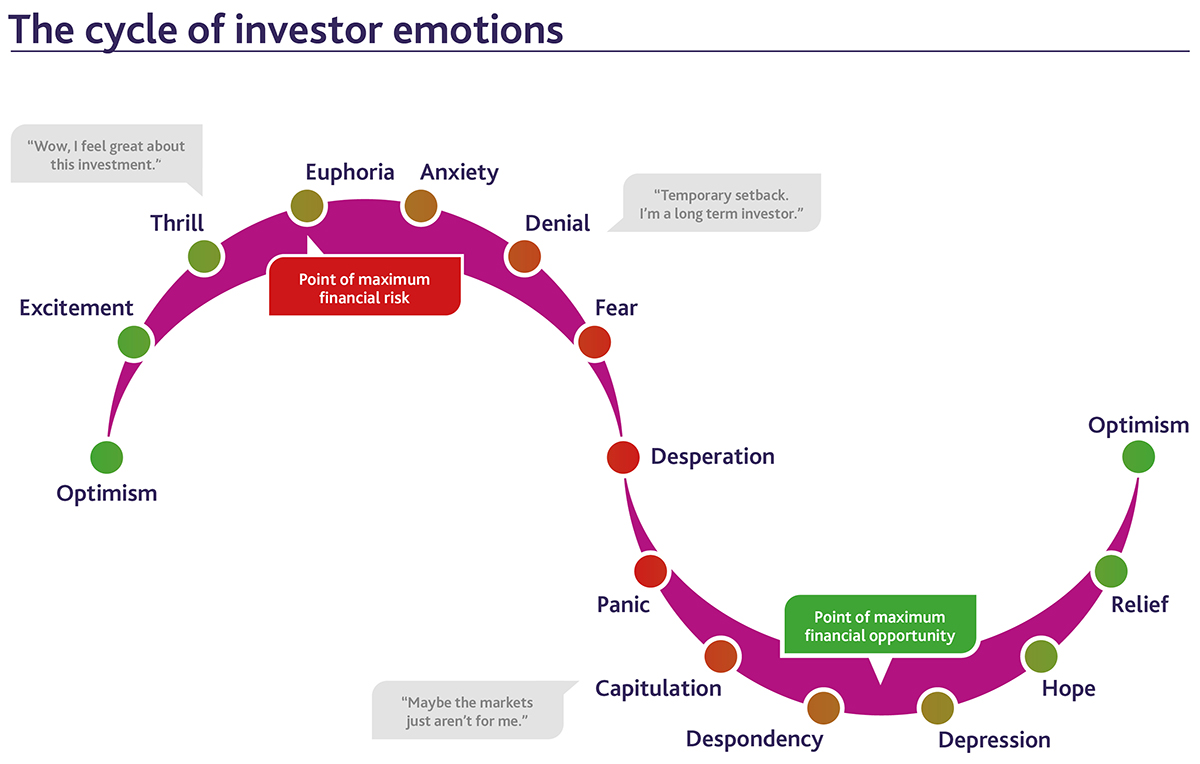

The cycle of investor emotions

It’s common for investors’ emotions to move in something of a cycle, similar to the one shown in the diagram below. The point of maximum financial risk lies at the top of the market curve. Here, there is the potential to make a decision motivated by short term gains, when it’s likely that the best gains have already passed.

Investors who wait until this point are often at risk of ploughing their cash into a market that might soon crash.

On the other hand, during times of rising market volatility, investors should remember the importance of looking beyond short-term market fluctuations and remember that although markets take time to recover, they usually do. If you sell during a downturn due to fear, you risk selling at the point where markets are lowest.

You are essentially at much greater risk of being harmed by the adverse effects of ‘bad timing’ if you let your emotions get the better of you.

A better perspective

Resisting your emotional impulses isn’t easy while in the grip of a savage bear market or a raging bull. Because of the risk of long term goals being overtaken by emotionally motivated decisions, a mindset shift is necessary.

You should try to avoid thinking of your investments as immediate assets and stop dwelling on the daily fluctuations to your net worth. Rather than thinking “I lost £15,000 today” on the day of a large market fall, try to think in terms of your averages and your long term financial goals. You might have lost £15,000 on a single, awful day, such as some we saw in the ‘Covid Crash’ earlier this year. However, your portfolio might have gained £300,000 in overall value.

A balanced, long term investment strategy generally has a couple of features:

Firstly, it takes into account that stock markets aren’t rational. You can’t rely on predicting the future of stock markets – billions have been lost on global markets to testify this.

When looking back at stocks, it’s easy to fall into the trap of thinking “I wish I had invested at this time”. Unfortunately, it’s impossible to actually work out when the perfect time to buy or sell is when it’s actually happening.

For instance, when markets fall, they often have small rises that form part of an overall downward slope. An investor might think that they are being smart by investing heavily in one of these ‘mini-troughs’, following the much lauded ‘buy low and sell high’ investment strategy. However, there’s no way of knowing for certain that this is actually the lowest point on the stock market. It might just be a momentary trough as part of a much steeper decline.

Another approach could be to consider ‘drip-feeding’ your money into investments, a strategy known as Pound Cost Averaging.

Secondly, stronger investment portfolios tend to be diversified. There’s that old saying about not putting your eggs in one basket. Investing all your money in one place makes you far more financially vulnerable if those stocks crash.

A stronger investment strategy would spread your money through different asset classes and different assets within each asset class.

Whatever investment strategy you use, it’s best to try to gain a bit of emotional distance from your investments. Understanding what emotions you’re likely to be feeling is a good way to enable you to make effective decisions, but don’t let these emotions rule you. Please get in touch if you have any questions about this article.

Production

Production